Leveraging recyclables to hedge against rising prices of raw materials

Written by Zeng Han-Jun

The driving force that is pushing for cleaner energy is clear. Urbanization will continue in many parts of the world and the challenges for the next lap, will still be the same, that is to provide relatively good quality housing, adequate nourishments and sufficient economic opportunities. Albeit this time, there is an intense focus on ensuring sustainability of global resources against our growth trajectory, while ensuring that our continuing and new actions do not add to the environmental pollution.

It’s really easier said than done, because our industries are hardwired for many decades, to produce goods and services in a certain way. Some of which are responsible for emitting high level of Greenhouse Gases (GHG) into our atmosphere, irresponsible extraction of water that leads to degradation of environment, non-circular agriculture practices that strip Earth clean of its natural carbon capture capabilities, etc.

On one hand, we have had significant number of investments that were poured into erecting these business DNAs. Business schools around the world extol these business constructs to its students, who then flock to all corners of the world, propagating those school of thoughts in words and in actions. On the other hand, we also have had growing demands for some of these goods and services, which really is a form of market confirmation. All these drive profits and further cement the ways of production like the ones we see now.

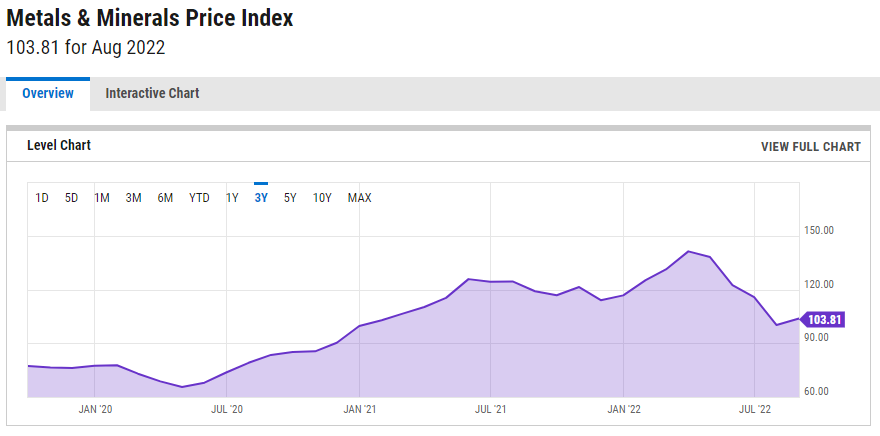

In preparing for the next few decades of growth, I believe that we need stronger push to pioneer more effective and cheaper ways of recycling materials, to the point that it makes market sense to adopt recycled materials for industrial production. It is practical to do so because raw materials are becoming pricier. Below is a chart from the World Bank showing the weighted average of aluminum, copper, iron ore, lead, nickel, tin and zinc prices. It has grown to 103.81 points in August 2022, from 65.55 points in April 2022 (start of the pandemic) and that is 58.37% growth over that period.

The 2008 recession sent this index way above 200 points. If a deep recession does occur in the short-term future, I would not be surprised to see similar dynamics playing out again. And with this possible development, any businesses that rely on new raw materials for production, could be in for a deep shock in the short-term future. Due to this, the operational costs of some businesses could rise approximately by more than 100%, completely eroding any profits and maybe even cash reserves.

A lot of companies could fall into this category, for example, window and door frame manufacturers, glass product manufacturers, tools and diecast products manufacturers, etc. Many of these companies are value-adding to our societies with their products and it would be great to see their continual contributions into the far future.

For this to happen, I strongly believe that the procurement and sourcing function has to work hand-in-hand with the recycling and development (R&D) function. Instead of sourcing for raw materials and procuring those resources directly from places of extraction, we have to shift our focus to looking for resources among waste. That is to think of waste as precious resource, and why not?

Many of the electronic products that were thrown away, do contain a lot of precious metals and minerals, and a lot of it could be put to good use again and again. Which is why I think that we need to identify the top 20% of the waste generators and from there, further filter out those that have performed excellently in tackling this problem, distill from their experience and scale it.

We need to tackle the “why”, asking really deep questions and coming up with answers that could shape our subconscious behaviors, activating a top-down reframing of societal values that could hopefully, gear us towards environment-friendly consumerism. At the other spectrum, we also need new tools to shape the risks and returns of corporate behaviors.

We genuinely have a growing waste problem, one that is driven by rapid urbanization and growing populations, our global annual waste generation is expected to jump to 3.4 billion tons over the next 30 years, up from 2.01 billion tons in 2016. To give some perspective about the size of this mammoth trash, a 1-ton truck can house about 10 people comfortably. 3.4 billion tons worth of 1-ton trucks can house about 34 billion people. At the moment, our global population is nearing 8 billion people and it is still nowhere near that size. We have a lot of trash, and we should be looking at ways to reusing these resources instead of dumping it into landfills or incinerating it.

There is a lot of business sense in developing corporate recycling programs. For example, a kitchen knife manufacturer that offers discounts or token points for consumers who decided to trade in their old kitchen knives for new ones. One, it promotes loyalty among the existing customers. Second, if the program extends to people who bought knives from elsewhere and want to upgrade with your kitchen knives. Then, you would have gotten yourself a new customer base and also more recyclable materials for your production. Third, your company is hedging against future prices of raw materials when it is able to tap on recyclables Fourth, when potential customers chose to upgrade their knives with your program, your company is, in a way, helping to reduce the amount of global waste. Fifth, it just shows how committed your company is to the sustainability drive and there is also a lot of good marketing in that.

There is a lot of business sense in recycling.

Copyright © 2022 Zeng Han-Jun. All Rights Reserved.