Moving the global mindshare towards a sustainable green future

Written by Zeng Han-Jun

Looking through the recent report released by Vivid Economics (VE), I cannot help but zoom into the stellar performance of Canada, how they have reversed their poor performance and topped the chart in creating stimulus packages that better our natural environment. The chart below, reproduced from VE’s report, is an index that attempted to capture the so-called greenness of stimulus package by 11 major economies. Basically, it is a measure of the amount of money that governments spent on stimulating their economies during the Covid-19 pandemic, and to check on how much of that contributed to greening our environment.

Canada did well, as you can see from this chart. The country managed to secure third place, ranking just behind the European Union, and they managed to pull this off from a negative Greenness of Stimulus Index (GSI) score in October 2020. Additionally, the country further pledged more than USD$12 billion over five years for public transport, cementing their support for their sustainability drive. This showed that the government is committed to improving and that strong environmental stimulus measures can overcome even poor past performance.

What Canada has done to achieve this, is that they have provided an entire suite of measures such as tax deferments, direct payments and wage subsidies in order to support local businesses. Those portions that went to supporting the agriculture, energy, green transport and nature-based solutions initiatives, helped to improve Canada’s GSI score. Those that went to supporting airport, airline support and road network development policies, contributed to the decline of Canada’s GSI score. Overall, after netting the improvements against the declines, Canada turned out pretty well, and as I mentioned earlier, the outcomes made me very interested in the details of the GSI framework.

The GSI framework took into account the amount of stimulus money that went into environmentally relevant sectors, existing green orientation of those sectors and the efforts to steer stimulus toward (or away from) sustainability. Based on the report, the environmentally relevant sectors are agriculture, industry, manufacturing, waste, energy and transportation.

We do not know the exact details of the calculations and what goes into the equations; Are there any weightages to the sectors? If so, how are the weightages are derived? Are the weightages adjusted for the environmental viability of the sectors for the short-, medium- or long-term outlook (for example, how does the introduction and impact of emerging technology such as sustainable aviation fuel, road surface chargers, etc, affect the transport sector)? Is the money spent, averaged against land size or per capita? How do they deal with those countries that do not have all the environmentally relevant sectors for example, agriculture? What about extremely pollutive sectors that cause direct and indirect environmental harm such as the fashion industry? Why do they exclude these sectors and include others?

We have no way of knowing these. In the case of Canada, the country pumped significant stimulus into the agriculture sector and that helped to push up the GSI score. Some countries may not have or are unable to have significant presence in certain sectors due to geographical limitations. Should these countries be included in the basket?

There are so many questions, but, then again, the survey and the index managed to give a rough sense of what each country is doing for their respective sustainability journey. Plus, it sort of emphasizes the importance of the role that government plays in advancing the green economy.

In fact, there are so many things that we have to do to green our future. My only fear is that we cannot visualize the vast number of details to keep things going; some of which require a total transformation of job scopes, in others the creation of entirely new jobs that we cannot even imagine now. All of which require substantive efforts in education, re-education, encouragement, policy shifts and private-public partnerships. All these, in order to shepherd as much interest as possible towards positive transformation. So, what else can we do?

Sustainability policy

We need a roadmap that fosters innovations to reduce dramatically the cost of adopting renewable energy. We know that the cost of production, especially for solar, is dropping. By right, that should tease countries into wider adoption of solar, but I argue that the adoption dynamics is not simply due to a single factor. The below chart is reproduced from IEA, and it showed that China accounted for 46% of the new generating renewable capacity added in 2021, mostly in offshore wind which increased sixfold. In Europe, solar accounted for most of the growth, with notable projects in Germany, Poland, France and Spain. India’s, ASEAN’s and MEA’s take up rate in the measured categories of renewable energy, paled in comparison to those of China’s, USA’s and Europe’s.

According to recent trailing 12 months estimates by IEA, the cost of polysilicon used in solar panels has more than quadrupled, while the price of steel rose by 50% and copper by 70%. Overall, raw material costs for all types of renewable energy were 15% to 25% higher. Inflation and uncertainties of global markets could add inflationary pressure on the already rising cost of materials, materials acquisitions and construction of renewable energy facilities.

Additionally, ESG regulations are closing onto mining activities, putting the lenses on mining’s impacts on the environment and nearby communities, energy sources used in mining operations, behavior of security forces in mining areas, treatments of waste discharges, exit strategies of miners from exhausted mines and the list continues. Plus, countries are going after the same materials that exist in finite amounts. All these compounds and complicates the acquisition of materials, but at the other end of the spectrum, I say that there has never been a brighter future for companies that are providing advanced recycling services.

Also, on the upside, I argue that there is a lot of potential for India, ASEAN and MEA to play catch up and it is important that they do. The military aggression by Russia in Ukraine has exposed not only vulnerabilities in the global supply chain network but also in energy policies. Renewable energy capabilities are ways to mitigate this issue, but we need innovations that further reduce the cost of adopting these alternative energy sources, for the reasons that I have stated above.

Transition strategy

Steering away from this, I want to dive somewhat into the operations underlying policies. Effective changes take time, require investment and need effort. All of these cannot gel unless there is significant cooperation between the people, public and private segments. In this, I see clearly that there is a lot of opportunities for transition finance to play a critical part in shaping the ongoing narratives that are brewing in different sectors along the short-, medium- and long-term future.

The details are important. For example, preparing the student body for the future of work, requires clever policies, cleverer implementations and smart monitoring. Smart monitoring is critical especially for large jurisdictions. Quick and drastic pivots are often… disastrous. Likewise for the existing workforce, judicious attempts should be made to pinpoint and identify largely similar work patterns between existing industries and future industries, thereby using the observations as a bridge for the transition. Similarly for equipment, just as Heckler and Koch adapted their sewing machines into the present-day sub machine guns HK MP5 or how some countries are adapting their hydropower dams into solar power plants, we must also adapt accordingly with the times. All these require innovators, scientists, engineers, education specialists, etc to come together and focus their collective intellectual prowess to effect a transformative change.

Establishment of climate change measures by the government

Elected governments should also play their parts well. Apart from establishing decarbonization policies and roadmaps for climate change measures, they could further enhance their value-add by (1) coordinating and facilitating collaborations between industry groups, financial institutions and various government agencies, (2) fostering an environment whereby public sector agencies and educational institutions are able to advance, retain and accumulate knowledge in specialized technical domains, (3) increasing awareness of sustainability and climate change issues among the citizens and encouraging them towards a Net Zero future, and (4) deploying government funds properly with an incentives and subsidies system that uplifts citizens towards a sustainability-oriented mindset – which is what I hope that the Green Stimulus Index (GSI) is trying to promote.

Public sector, unlike most in the private sector, have the capacity to look further across the horizon, and plan for the future. Public sector agencies usually are not tied to short-term demands for financial performances that are largely driven by profit-seeking actors. In fact, some public sector agencies are able to aggregate data from various sources, to construct a slightly better-informed picture of what is going on in the world, and they should make good use of that advantage.

These public sector players are able to establish trends and recognize patterns that may not be so obvious to some of their private sector counterparts. As such, they should work closely with the markets to shape and move the conversation towards the greater good for everyone, all these while balancing the private sector’s profit-seeking behavior. This creates a win-win-win outcome for people, public and private sector. Some private sector counterparts are in the better position to harness useful data and subsequently develop meaningful information. These organizations could explore to ease any potential frictions with policy makers, by extending their capabilities to augment policymaking and of course, treading carefully along and around privacy issues.

Establishment of a green financial system

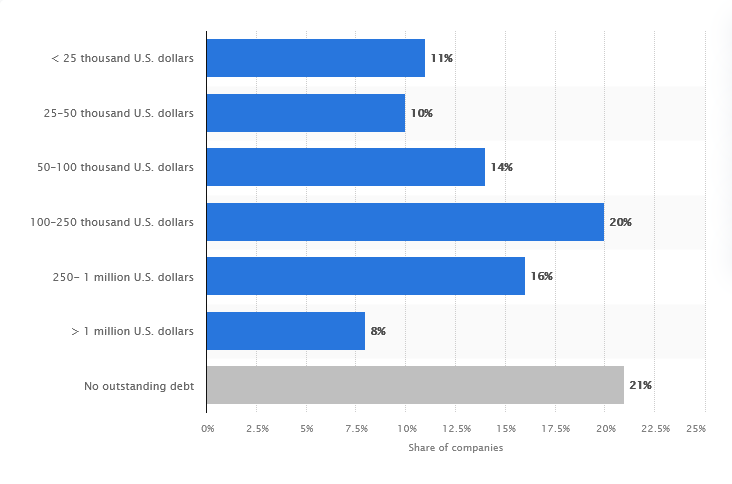

The financial system should play a strong support role to what the governments are doing. According to the result of a survey conducted across 9,443 respondents in 2020, published by Statista in 2022 and reproduced below, 14% of small- and medium-sized companies in the United States had debt outstanding between USD$50,000 and USD$100,000. This means that 79% had outstanding debts. Plus, NASDAQ recently reported that there are still strong demands for bonds despite the Fed looking to raise interest rates in order to keep inflation in check. This goes to hint that the financial markets, through its various instruments, should still have some level of influence over corporate behavior.

If they are seeing what the public sector is seeing, and also in preparation for changing consumer behavior and job-seeking behavior for example, like those that would surface from the emerging Gen A cohort. Then, it would be logical to put in place the pillars and sandboxes for innovations, digital platforms, external certifications, ratings, accounting standards, risks metrics, risks appetites, etc. Additionally, also shaping intermediaries like venture capitalists, private equities and working with game-changing actors like FinTech providers.

This could enable a new financial market that is in a better position to handle green products with clear sustainability-linked KPIs, for example, private-public partnerships, infrastructure finance, transition finance, blended finance, green bonds, ESG funds, sustainable indices, securitization and derivatives, etc.

Financial markets should work closely with industry experts and government bodies to chisel and chip away bits and pieces of old financial framework, artfully hammering out a roadmap for green finance in general. Changes such as developing a sensible carbon pricing system, strengthening transparency, promoting information disclosure and tweaking the incentive framework amongst others, to shape risk and return, is a definite must. This would help in proliferating extensively and intensively the sustainability mindshare.

Copyright © 2022 Zeng Han-Jun. All Rights Reserved.